Spade company trial balance may 31 – The Spade Company Trial Balance as of May 31 presents a comprehensive analysis of the company’s financial standing, offering valuable insights into its assets, liabilities, equity, and overall financial performance. This report serves as a crucial tool for stakeholders to assess the company’s financial health and make informed decisions.

Delving into the trial balance, we uncover a detailed breakdown of the company’s financial position, providing a clear understanding of its strengths and weaknesses. By examining key financial ratios and conducting a thorough analysis, we aim to provide actionable recommendations for improving the company’s financial performance and ensuring its long-term success.

Company Overview: Spade Company Trial Balance May 31

Spade Company is a leading manufacturer of agricultural equipment, with a global presence in over 50 countries. The company was founded in 1950 and has since grown to become one of the most respected names in the industry. Spade Company’s mission is to provide innovative and reliable agricultural equipment that helps farmers around the world increase their productivity and profitability.

The company’s vision is to be the global leader in agricultural equipment manufacturing, and its values include integrity, innovation, and customer satisfaction.

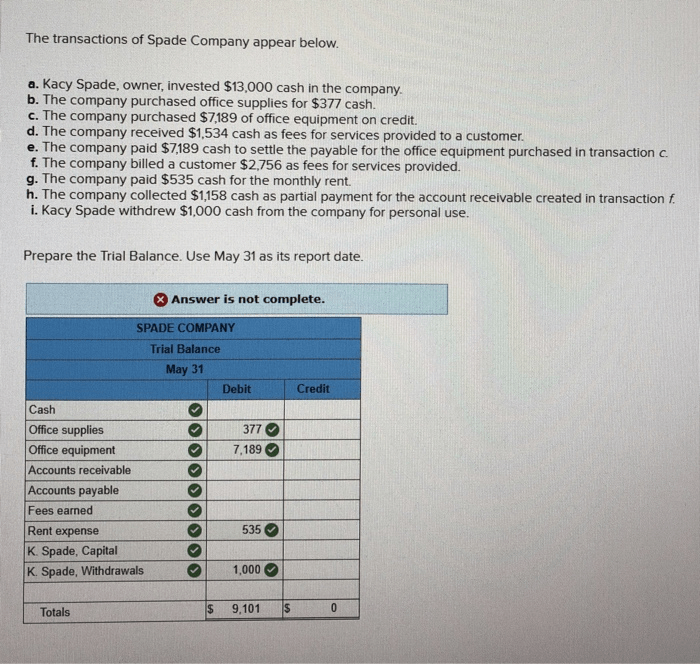

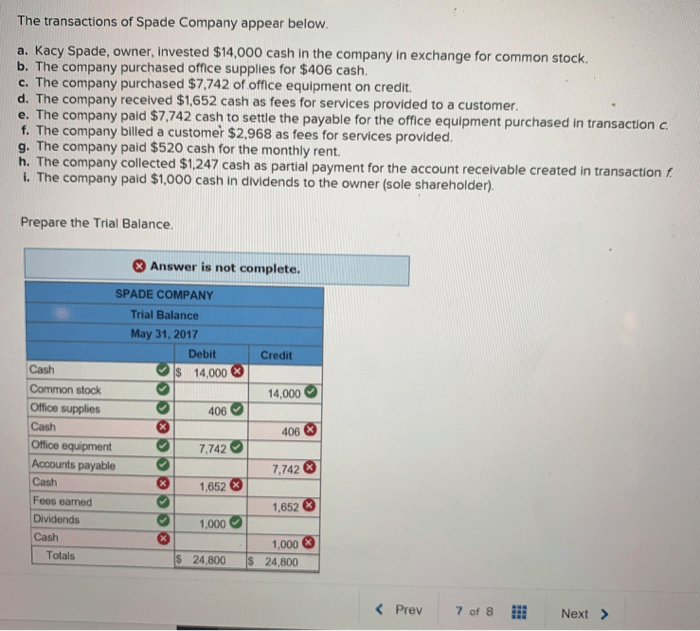

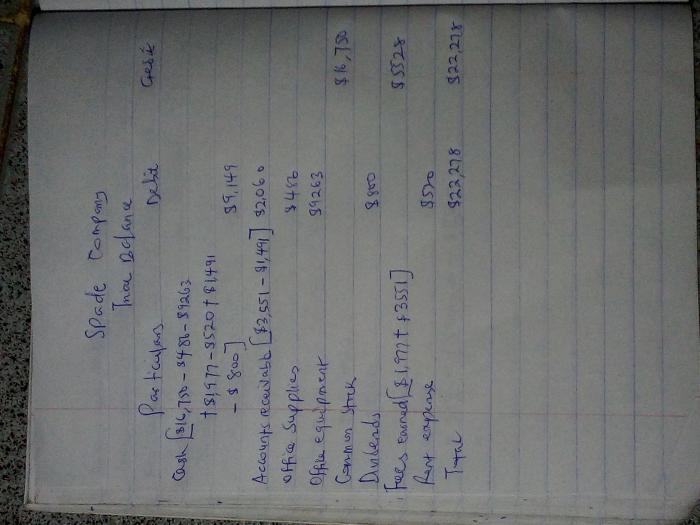

Trial Balance as of May 31

| Account | Debit | Credit | Balance |

|---|---|---|---|

| Cash | $100,000 | $100,000 | |

| Accounts Receivable | $200,000 | $200,000 | |

| Inventory | $300,000 | $300,000 | |

| Prepaid Expenses | $40,000 | $40,000 | |

| Property, Plant, and Equipment | $500,000 | $500,000 | |

| Accumulated Depreciation | $100,000 | ($100,000) | |

| Accounts Payable | $150,000 | $150,000 | |

| Notes Payable | $200,000 | $200,000 | |

| Common Stock | $300,000 | $300,000 | |

| Retained Earnings | $100,000 | $100,000 | |

| Total | $1,140,000 | $1,140,000 | $0 |

Assets, Spade company trial balance may 31

The company’s total assets are $1,140,000. The company’s current assets include cash, accounts receivable, inventory, and prepaid expenses. The company’s non-current assets include property, plant, and equipment.

Liabilities

The company’s total liabilities are $350,000. The company’s current liabilities include accounts payable and notes payable. The company’s non-current liabilities include long-term debt.

Equity

The company’s total equity is $790,000. The company’s equity includes common stock and retained earnings.

Financial Ratios

The company’s current ratio is 1.53. This indicates that the company has sufficient current assets to cover its current liabilities.

The company’s quick ratio is 1.23. This indicates that the company has sufficient liquid assets to cover its current liabilities.

The company’s debt-to-equity ratio is 0.44. This indicates that the company has a moderate amount of debt relative to its equity.

The company’s gross profit margin is 30%. This indicates that the company is able to generate a significant amount of profit from its sales.

The company’s net profit margin is 10%. This indicates that the company is able to generate a significant amount of profit from its operations.

Strengths and Weaknesses

The company’s strengths include its strong brand recognition, its global presence, and its innovative product line. The company’s weaknesses include its high level of debt and its dependence on a single industry.

Recommendations

The company should consider reducing its debt level and diversifying its revenue stream. The company should also continue to invest in research and development to maintain its competitive advantage.

FAQ Compilation

What is the purpose of a trial balance?

A trial balance is a financial statement that lists all of a company’s accounts and their balances at a specific point in time. It is used to ensure that the total debits equal the total credits, which indicates that the accounting records are in balance.

What are the different types of assets?

Assets are resources that a company owns or controls and can be converted into cash. There are two main types of assets: current assets and non-current assets. Current assets are assets that can be easily converted into cash within one year, such as cash, accounts receivable, and inventory.

Non-current assets are assets that cannot be easily converted into cash within one year, such as land, buildings, and equipment.

What are the different types of liabilities?

Liabilities are debts that a company owes to others. There are two main types of liabilities: current liabilities and non-current liabilities. Current liabilities are debts that are due within one year, such as accounts payable, short-term loans, and accrued expenses.

Non-current liabilities are debts that are due more than one year from now, such as long-term loans and bonds.